China’s Off-the-Grid Lending

In the shadows.

Even the name sounds sketchy: “shadow bank”. An apt moniker for a business that lends like a bank, earns interest like a bank, has a pleasant and confidence-inspiring name like a bank, yet isn’t exactly a bank—particularly when it comes to regulations, transparency, and risk control.

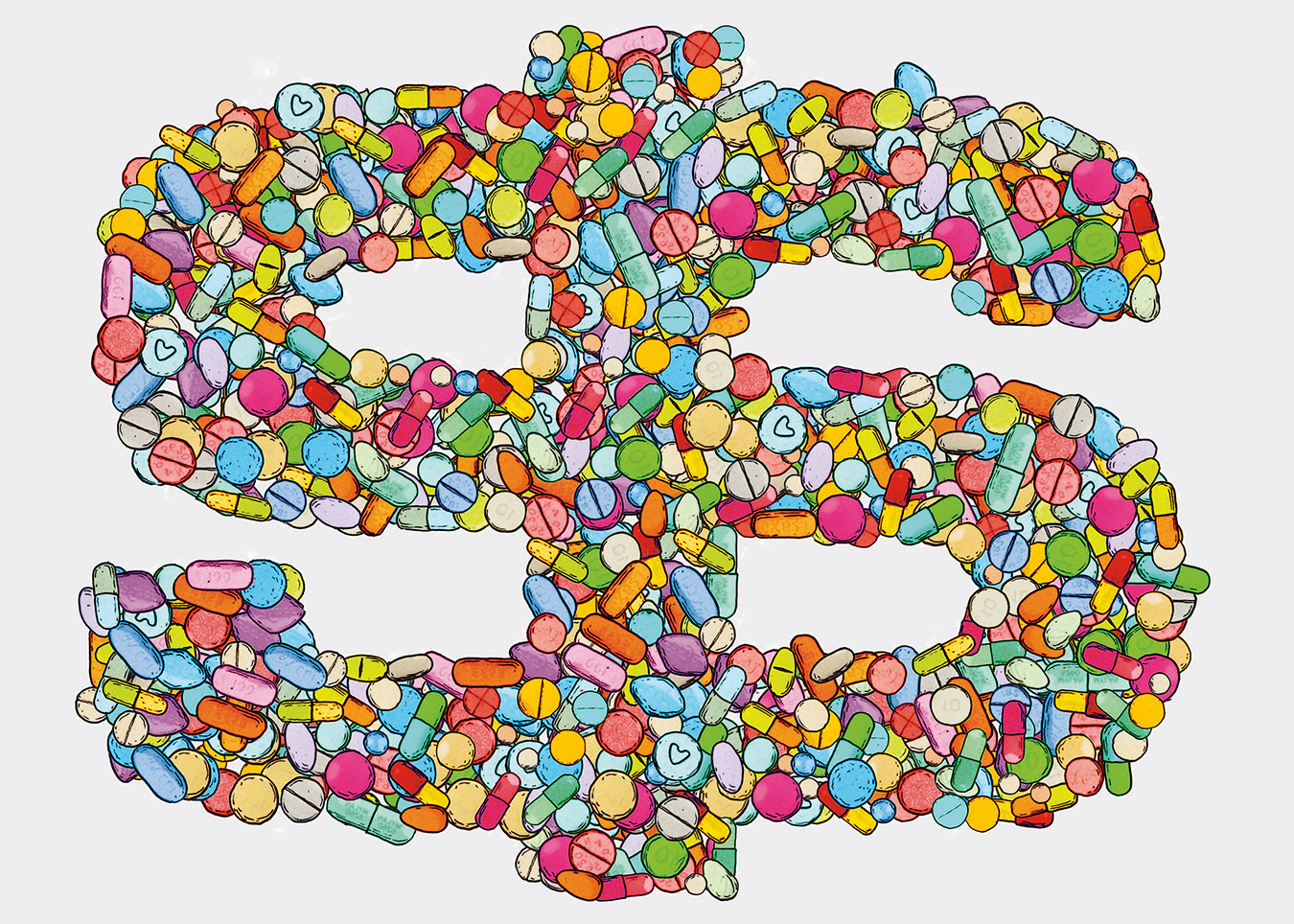

The rise of shadow banking has been a global concern for some time now, nowhere more so than in China. There, tight lending restrictions and state-owned banks’ penchant for backing state-favoured enterprises and state-connected entrepreneurs have given birth to an entire sector of non-traditional lenders (trusts, securities firms, specialist financiers) that are in the business of making loans when banks won’t. Such is the appetite for this lending that U.S. investment bank J.P. Morgan estimated that as of September last year, China’s shadow-banking sector makes up about 84 per cent of the country’s GDP.

Of course, non-traditional loans naturally come with non-traditional interest rates—a fact that has not gone unnoticed among Chinese investors tired of rock-bottom interest rates on savings accounts. This in turn has led many shadow banks to package their loan portfolios into “wealth management products” and sell them to retail investors via state-owned banks. The result: a tangled web of off-balance-sheet entities and interconnected loans that makes it impossible to know how much cash is sloshing around, and for what purpose.

Recently, the web has shown signs of unravelling. On January 31, government media announced that Credit Equals Gold #1 Collective Trust Product had defaulted on its interest payments, having been burned by an almost $500-million loan made to a now-defunct coal company. Soon after, Jilin Province Trust announced it would do the same. Cause of death: a $126-million loan to a similarly ill-run coal company. An ominous sign, given six other trusts had lent more than $825-million to the same enterprise.

The irony is fitting given that such defaults may be the canary in a coal mine that is China’s shadow-banking industry. By some estimates, over 8,500 trust products representing about $210-billion in value will mature this year—it’s possible that many of them will find themselves on the wrong side of insolvency. Or not. Trying to get anything more than an estimate of who owns what to whom in China is akin to reading the I Ching through a smudgy window. The gist is clear enough, but getting precise details from incomplete, out-of-date, “government-managed” data is more difficult.

Whatever happens, investors will be watching closely for signs that the pall cast by the shadow banks is spreading to other parts of the Middle Kingdom. Shadow banks have been financing China’s infrastructure build-out for several years now—a boom that has benefited commodity producers and exporters around the world. If the money dries up and the boom goes bust, look out below.

Then again, China’s shadow banks have something going for them that Lehman Brothers didn’t: one-party rule. It’s hard to believe the Central Committee is looking forward to a headline-grabbing financial apocalypse. More likely it will use the full breadth of its powers to bail things out and smooth things over. No doubt both capitalist and Communist will approve.