The Canadian Dollar

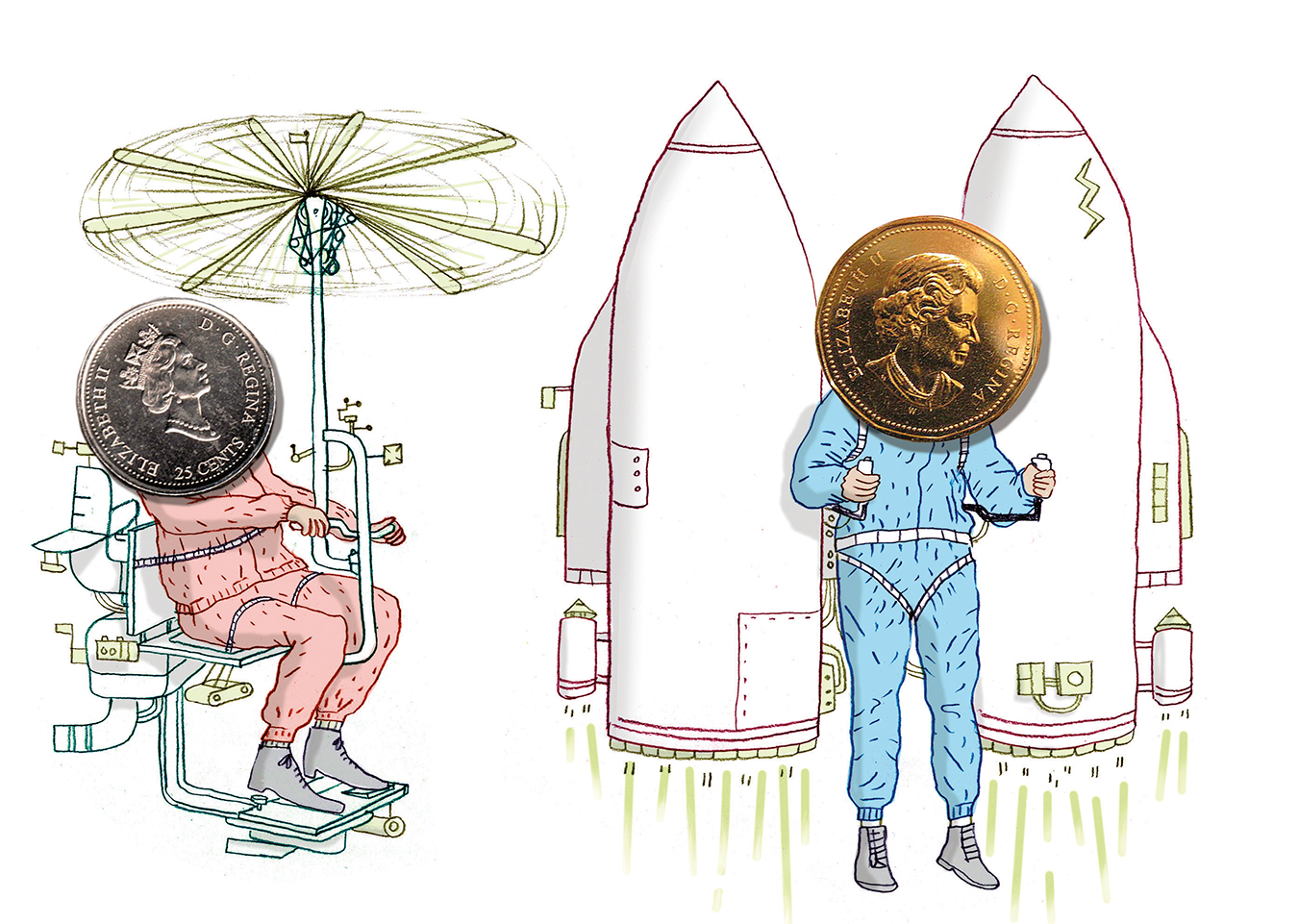

Ready for takeoff.

It used to be the easiest job on Bay Street. In days gone by, one required neither an advanced degree in economics nor a crystal ball to predict the performance of the Canadian currency. The ultimate direction of the motion was a given; the only challenge was one’s choice of words—whether to best describe that motion as a fall, crash, or plummet.

Pity the economist charged with the job today. Over the past several years, the loonie’s gyrations—in both directions—have made life extraordinarily difficult for even the most Promethean of currency analysts.

First, there was the rise: a confluence of strong commodity prices, diminishing government borrowing, and rising oil and gas prices transformed our beloved loonie from also-ran to top performer among world currencies. Since bottoming out at 62 cents per United States dollar back in November 2001, the Canuck buck rose to $1.10 in November 2007. For those keeping score, that’s a rise of over 77 per cent, or a little over 10 per cent per year.

Then came the fall: as the financial crisis crested and broke over the world’s stock markets last year, investors rushed to the relative safety as the world’s reserve currency, the U.S. dollar. Other currencies were jettisoned overboard as investors sold everything—equities, bonds, real estate, currencies, commodities, hedge funds, the family silver—and bought billions’ worth of U.S. Treasury bonds. Among the casualties was our loonie, falling from 96.73 cents U.S. on September 25, 2008, to a low of 76.59 cents U.S. on March 9, 2009—a drop of over 20 per cent in a matter of six months.

And now, the rebirth: as equity markets have risen from their lows, so too has our dollar. Since its March low, the loonie has risen to a high of 97.15 cents U.S. as of October 19. With the prospect of higher oil prices, strengthening demand for commodities, and a federal deficit that’s modest by international standards, the recent rise may be merely a prelude of what’s to come.

Mixed Blessings

Whether that’s something to celebrate is another matter. While most Canucks respond to the strength of their buck with quiet yet palpable pride, most economists consider the loonie’s recent performance to be a mixed blessing.

On one hand, a strong loonie is good for consumers; everything from Japanese cars to French pâté is a good deal cheaper when translated into dollars from yen, euros, or most any other of the world’s currencies. Snowbirds and other travellers are likely to cheer on the loonie’s rise, as well: lower prices for airfare, accommodation, and other expenses has made the annual migration south of the border considerably easier on the wallet.

For anyone involved in the export business, however, the loonie’s flight has been more difficult to applaud. For years, a favourable exchange rate offered Canadian manufacturers and commodity producers a sizeable advantage over their U.S. counterparts. As the value of the North American currencies has converged, that advantage has evaporated. The fact that this is happening in the midst of a severe economic contraction only makes life more difficult.

With the stakes this high, it’s understandable why the financial pages have been full of discussion about the pros and cons of a stronger or weaker dollar. What to make of all the chit-chat is less than clear.

The View From Above

All of which has made George Davis a very busy man. As a former senior currency trader at Canada’s biggest bank, Davis has spent much of his career buying and selling everything from dollars to dinars on the foreign exchange (FX) markets. He now puts his talent to work as the director and chief technical analyst for currencies, commodities, and interest rates at RBC Capital Markets, the corporate and investment arm of Royal Bank of Canada.

While his years of trading have given him a broader perspective on the recent turmoil in the currency markets—watching the loonie soar and dive is certainly nothing new—Davis admits the recent volatility hasn’t made his job easy. “It’s certainly made for very interesting times,” Davis says with an understated chuckle. “What we’ve seen … is unprecedented, for 99 per cent of the people in the market.”

Not surprisingly, Davis places the blame for the trouble squarely at the feet of the financial crisis that’s gripped the world’s economies for the past several months. “The credit crisis, the collapse of various global [retail] and investment banks, and the real estate crisis have all drastically altered the financial landscape,” Davis points out. “Volatility is a by-product of the markets readjusting to this ‘new reality.’ ”

As Davis explains, this too will pass. Once traders shift their focus from risk aversion to economic fundamentals, Davis expects the Canadian dollar to start climbing toward parity again. “From a trend perspective, I certainly think that’s where we’re headed,” he says. As to when that might happen, Davis is guarded with his answer. “We could see the [loonie] touch parity this year, or the first half of next year, but at this point, we’re a little skeptical that’s going to be sustained. Over the next six, nine, 12 months, we’re still going to have some potholes in the road ahead. There are going to be starts and stops. We might get some setbacks.”

Over the longer term, however, Davis is much more unqualified with his optimism. Although the complexity of the FX markets make predictions more than a little difficult, Davis believes the long-term case for the Canadian dollar is a strong one. The combination of a strong worldwide demand for commodities, a firm commitment to ongoing fiscal health from both federal and provincial governments, and increasing prices for oil and gas should clear the loonie for takeoff.

End Of An Era?

South of the border, the situation could not be more different. With a ballooning federal deficit, anemic economic growth, and stubbornly high unemployment, the financial mess in the U.S. has gone from bad to worse in short order. Bad news for the greenback; good news for the loonie.

“It’s a relative value proposition,” Davis says dryly. “When you look at what’s going on in the U.S., unfortunately for them, the risk is that we’re going to see a massive increase in the deficit. I think at some point we’re going to be in for another fairly major down leg in the U.S. dollar. That’s going to be another positive factor that can help the Canadian dollar along.”

So does this mean that the days of the greenback’s dominance as the world’s go-to currency are over? Davis for one doesn’t think so. “It’s unlikely that the U.S. dollar will fall out of favour quickly over a number of days, weeks, or months,” he says. “We may see investors diversify their holdings, so the U.S. dollar is not as heavily weighted in their portfolios. But this will be a very gradual process that will take place in small steps, over a number of years.”

If anything, once the U.S. puts its fiscal house in order, the greenback should start to look a lot healthier. “A reduction in the [U.S. federal] deficit would remove some key factors that are eroding the value of the greenback,” Davis explains. “So, from a trend perspective, it would allow the U.S. dollar to appreciate against most global currencies.” Even so, Davis believes Canada’s strong economic ties to the U.S. will likely mitigate at least some of the rise, allowing the loonie to hang onto a good portion of its gains against the greenback in years to come.

Flying High

Of course, wherever there’s volatility, there is opportunity for the quick and the savvy to make money. The FX markets are certainly no exception. “People are realizing there are opportunities in the foreign exchange market,” Davis says. “We’ve seen a significant increase in participation of the individual investor in currency markets over the past five years or so.”

At the same time, Davis stresses that currency trading isn’t a pastime one should enter into lightly. “It’s not a game for the faint of heart,” he says emphatically. “People have to realize the dynamic of the foreign exchange market is very different. It’s not for the novice investor.”

The reason is simple: currencies are complex. Not every investor has either the brain or the stomach to profit from currency movements. “The FX markets are unique in that they really encompass everything that’s going on in the world,” Davis explains. “If something happens politically, the FX market will react. If something happens economically, the FX market will react. If something happens [with] a large merger and acquisition announcement, the market will react. When people start [trading currency], they have trouble synthesizing that dynamic.”

Instead of trying to profit from the loonie’s ups and downs, Davis suggests investors may be better served by defending existing U.S.-denominated investments from the rapid appreciation of the Canadian dollar. “That’s certainly something people should look into in terms of their current holdings,” he says. Not surprisingly for a former currency trader, Davis advocates using options or futures contracts to mitigate U.S. dollar exposure. “They should be given serious consideration in the current environment.”

At the same time, Davis reiterates that some investors just aren’t cut out to trade currency. “Currencies are a different kettle of fish,” he admits. Those without in-depth knowledge or trading expertise would be better to follow the loonie’s flight with casual rather than vested interest. “If [investors] don’t have that sophistication, there’s certainly a reason to perhaps factor out the FX risk and just focus on the investment you’ve made.”