He is an imposing figure, this walking man: fully six feet tall, naked, his stick-thin limbs disproportionately long, his metallic skin clearly showing the rough handiwork of his creator.

David Foldvari

(Not So) Great White North

Ahhh, those were the days. In 2008, the world economy was swooning. Stock markets on all five continents were in freefall. The titans of Wall Street were drowning in an ocean of red ink—as were several European countries. There, amidst the financial apocalypse stood Canada.

Brave New World

It was all Jim O’Neill’s fault. In November 2001, the chair of Goldman Sachs’ asset management division started talking about how the BRIC countries—Brazil, Russia, India, China—would soon outstrip the developed nations and come to rule the economic world.

The Rise of Private Equity

That street vendor hawking Japanese-style hot dogs in front of your office tower. That place on Main Street that’s been selling carpet since forever. That multi-billion-dollar conglomerate that’s into everything from automotive retailing to radio broadcasting to apple juice. They all have something in common: they’re all privately owned. And they’re all making money hand over fist.

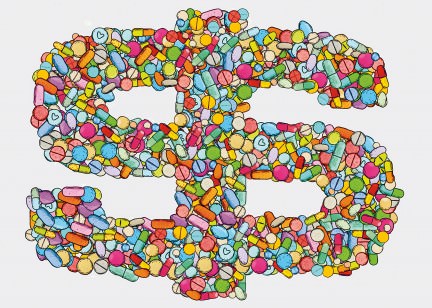

Investing in Health Care

Death, taxes, and the lengths to which we will go to avoid either: three things of which we can be reasonably certain in this increasingly uncertain world. Such wisdom accounts for the ongoing popularity of, among other things, organized religion and offshore tax havens. It also goes a long way to explaining why health care may be the best investment idea of all time.

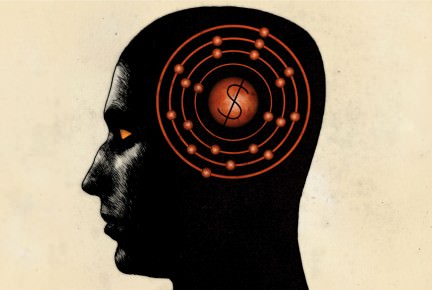

The Bond Market

People invest for many reasons, but at the foundation of them all is the expectation of your investment appreciating over time; to get more money out of the effort than you put in. Someone has apparently forgotten to pass the memo on to bond investors.

The Economics of Investing in Food

Keep your eye on the register as your cashier rings up your groceries. Notice something? That’s right: you’re paying more than you used to for everything that passes by the bar code scanner. And that, dear reader, could very well be the best investment idea you’re likely to hear over the next decade.

The Big Give

After a lifetime of financial freedom and material abundance, how does one make meaning out of one’s millions? Giving back to the community, helping those less fortunate, improving the world—all noble goals. But how, practically, does one do it? How can one get good work done while getting the best bang for one’s charitable buck?

Hot Commodities

When it comes to making money, commodities offer plenty to get excited about. In fact, over the past decade, instead of putting your hard-earned cash into big-name brands, blockbuster drugs, or high-flying dot-coms, you would have been far better served by investing in rocks and stones: zinc, copper, potash, gold, uranium, and a variety of other metals and minerals.